Bookkeeping service is said to be the bedrock of the sound financial position of any business organization; however, it is of most crucial consideration to small business organizations. Whether an owner of a new business start-up, a local boutique store, or a consultancy service, book-keeping services in general and the tracking of each cent earned or spent, in particular, is valuable for several reasons.

1. Making choices about money

The financial information for small businesses is used to make most of the big business choices for big businesses. It’s clear from this presentation that professional bookkeeping services can give you information about things like cash flow, income, and costs. With this information, the business owners will be able to agree on the prices that need to be set, the available investment opportunities, and the ways that costs can be cut. These kinds of choices are made based on assumptions when records are not kept very carefully. This puts the companies at great risk.

2. Paying your tax

There are many and vary depending on the country or area they are talking about. Tax forms must be filled out and filed correctly by small businesses, and payments must be made on time. When businesses have full accounts, they can keep track of all of their earnings, spending limits, and discounts. This way, they can meet standard tax return requirements without raising any red flags with the tax authorities.

3. Making plans and predictions for a business

As a result, planning is seen as one of the most important things for the growth and survival of small businesses. The Aqua Solution business records give a picture of the company at a certain point in time, which is very important for making realistic working budgets that help with achieving goals and planning for future financial needs. Keeping good books is important for planning, whether a business has grown or shrunk, needs money, or needs to make changes every day because of the seasons.

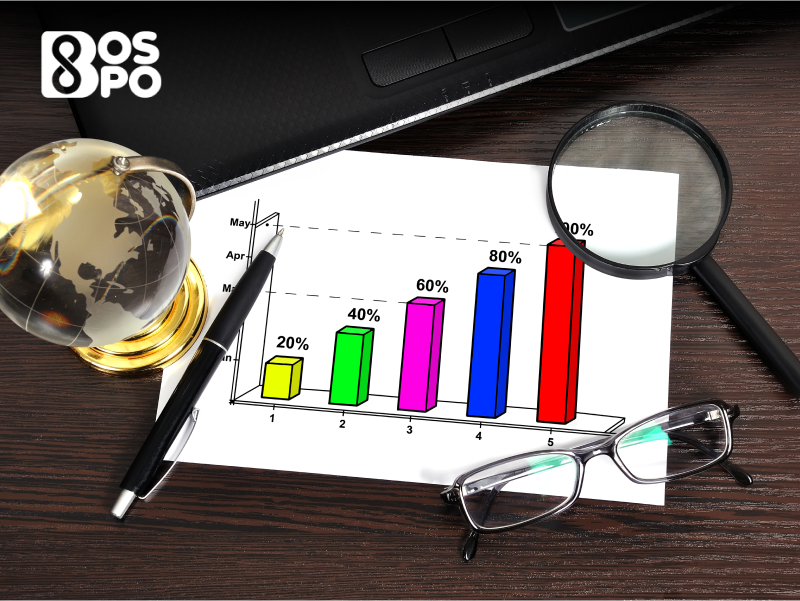

4. Measuring business outcomes

Based on the above-stated argument and from the findings, we can conclude that Newberry’s small business performance can be monitored over time by the evaluation of the financial statements prepared from accurate accounting records. Two more examples of KPIs that could be computed are gross profit margin, and net profit margin while ROI makes it clear at which area business productivity is weak to identify the weak links. This monitoring assists in studying the transformations in the market and assists one in sustaining their business profits in the future.

5. Dispensing with the investors and Lenders

Consequently, for any start-up and small business seeking outside cash in the form of financing or investment, compliance with factual account information is inevitable. Thus, the financial statements assist the investors and the lenders in their investment in the business on its profitability and stability and the ability of the business its future growth. Businesses with clean books are relying on stakeholders and this may result in the board getting more opportunities for funding hence business growth.

6. Legal Compliance and transparency

Besides taxes, the accurate bookkeeping service also comes in handy in the fulfillment of other legal and statutory requirements. With the help of records of payrolls, meter readings and other related expenditures data maintenance of accounting records gives the true picture of cash flow and the overall functioning of the organization. It also assists the company in avoiding being associated with the law, although, on the other hand, it assists in maintaining a good reputation of the business to the customers, suppliers, and other business associates.

| Aspect | Details |

|---|

| Importance of Bookkeeping | Bookkeeping is essential for tracking income and expenses, maintaining financial records, and ensuring compliance with tax regulations, particularly for small businesses. |

| Types of Bookkeeping Services | Bookkeeping services include payroll management, invoicing, tracking receipts, and financial reporting, tailored to meet the needs of small business operations. |

| Benefits for Small Businesses | It helps small businesses manage cash flow, prepare for tax season, and make informed financial decisions, ultimately contributing to the growth and sustainability of the business. |

| Tracking Income

and Expenses |

Bookkeeping allows businesses to accurately record all financial transactions, ensuring that every cent earned or spent is accounted for. |

| Financial Reporting | Regular financial reports, such as balance sheets and profit/loss statements, provide a clear picture of a business’s financial health. |

| Tax Preparation | Proper bookkeeping ensures that all necessary documentation is ready for tax filings, avoiding penalties and ensuring compliance with government regulations. |

7. Economic profile and industry indicators

Small businesses start in competitive contexts where it is possible to get to understand the specific market and the pattern in the economy. Using the accounts concerning other similar businesses, there are areas in the specific business that can be tweaked for more income generation and less spending thus making the business more profitable. For the full hrm report, please click here they assist the small business person in competing as well as reacting to all forces that exist in the business environment.

Does Your Business require Accounting Services? Choose BosBPO!

Strengthen your small business’s outcome by acquiring BOSBPO experienced bookkeeping services. We have professional employees so that a company can have a quality and effective financial report, tax return, and advice on Corporate financial matters. Whether you are a start-up business or a busy enterprise, now is the right time to put your back-office bookkeeping in the hands of the experts at BosBPO for enhancement. You can get in touch with us today and let us tell you more about how we can assist you in growing your business.

Conclusion

Consequently, it is possible to state that effective bookkeeping is not merely an everyday task, but also an important key success factor in actively implementing small-scale enterprises. It gives thinking of funds and arranging required for dealing with troubles and grasping the opportunity as well as ensuring achievement at the end of the week. This therefore implies that with proper bookkeeping standards or with assistance from experts on issues to do with bookkeeping for people owning the small business it is easy to rely on sound numbers.

Read Also: Benefits of Outsourcing to a BPO Agency: Why It’s Worth It?

FAQs

1. Why is it important for a business to keep track of its books?

Care must be taken to keep accurate records because they give the owner of a small business important information about its finances. It helps with making decisions about prices, amounts to be spent, and costs that have to do with money. In addition, it helps a company meet tax laws so that penalties and auditors are less likely to happen.

2. The following questions were made to help guide this paper: For a new small business, what are the pros of hiring someone else to do the books?

As a small company owner, if they hire someone to do their bookkeeping, they can focus on other important tasks, plus they have a professional bookkeeper available whenever they need one. They save businesses the trouble of hiring and training new employees, give businesses access to experts, and make the information they use for financial reporting more reliable.

3. How often should a small business make changes to its records?

It is suggested that small businesses keep their records of financial transactions up to date at least once a year, ideally every month. This makes sure that all business operations, money coming into or going out of the company, and financial transactions are recorded right away. They also help people make the right choices, improve management, and keep the business’s finances in good shape.

4. Which of the following are important financial records that small business owners should always look over?

Small business owners should look over their income statement, statement of financial situation, and statement of cash flows every so often. Additionally, the profit and loss account, which is also called the income statement, should also be looked over. These reports give him an idea of how profitable his business is, how liquid it is, and how well it is doing overall. With these reports, you can look for trends, see if the company is solvent, and even plan for future growth.